south carolina inheritance tax 2019

However some of these states find ways to collect taxes in other forms. Very few people now have to.

Real Estate Newsletter Template Spring 2020 Newsletter Real Etsy In 2021 Real Estate Marketing Real Estate Real Estate Agent Marketing

South Carolina has no estate tax for decedents dying on or after January 1 2005.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

. For example 62 localities in Alaska collect local sales taxes ranging from 1 percent to 7 percent. Large estates may be subject to the federal estate tax and you may need to pay inheritance if you inherit property from someone who lived in another state. South Carolina Inheritance Law Resource.

You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to more than 12060000 for 2022. State Sales Taxes. Tax was permanently repealed in 2014 with repeal of all of.

Massachusetts has the lowest exemption level at 1 million and DC. It can be confusing to sort out the process the taxes and the issues that arise after someones death. Every state has its own unique set of laws that go into inheriting estates and south carolina is no exception.

- 28 -. Learn about the self-help resources available to you at the Dorchester County Probate Court. If an estate is worth 15 million 36 million is taxed at 40 percent.

Heres a quick summary of the new gift estate and inheritance changes that came along in 2019. Even though South Carolina does not collect an inheritance tax however you could end up paying inheritance tax to another state. This is because the six states that assess an inheritance tax tax the recipient of an inheritance no matter what state he or she is living in.

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. As an example consider the family from Pennsylvania who moved to South Carolina. For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000.

An inheritance tax is a tax based on what a beneficiary actually receives from an estate. Note that in addition to estate taxes an estate in South Carolina may be subject to New York Inheritance Tax federal and South Carolina income taxes and other liabilities. All six states exempt spouses and some fully or partially exempt immediate relatives.

The following five states do not collect a state sales tax. IRS 2018 Estate and Gift Tax Update Source. Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption.

2019 the New York estate tax exemption amount will be the same as the federal estate tax applicable exclusion amount prior to the 2017 Tax Act which is. You should also keep in mind that some of your property wont technically be a part of your estate. Alaska Delaware Montana New Hampshire and Oregon.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. This site will help.

SC residents need to know about Inheritance Law What South Carolina Residents Need to Know About Inheritance Law - 28 - - - 2020-09-14 -. Iowa has a separate inheritance tax on transfers to others than lineal ascendants and descendants. South Carolina does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax.

South Carolina does not levy an estate or inheritance tax. For instance if Mom and Dad die with 3000000 in their estate but they have three children who each inherit 13 of that estate 1000000 then each of the children may pay an inheritance tax on the 1000000 received if they live in a state which has an inheritance tax. Neither South Carolina nor North Carolina have an inheritance tax but people who live here are sometimes still forced to pay inheritance taxes.

Maryland imposes the lowest top rate at 10 percent. See where your state shows up on the board. South Carolina does not have these kinds of taxes.

File Pay Check my refund status Request payment plan Get more information on the notice I received Get more information on the appeals process Contact the Taxpayer Advocate View South Carolinas Top Delinquent Taxpayers. In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation. South Carolina residents do not need to worry about a state estate or inheritance tax.

Individual Taxes Individual Income Estate Fiduciary Property Use. November 2019 3 october 2019 2 september 2019 3 august 2019 4 july 2019 2 Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. Whats New for 2019 for Federal and State Estate Inheritance and Gift Tax Law.

Has the highest exemption level at 568 million. Clients should seek the advice of a competent attorney to determine whether and how much estate tax liability may be applicable in specific situations. Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent.

Dorchester County Probate Court.

Evan Guthrie Law Firm Law Firm Family Law Guthrie

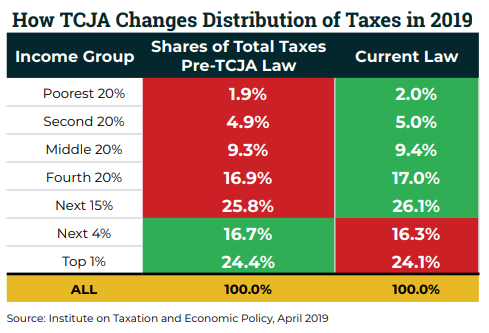

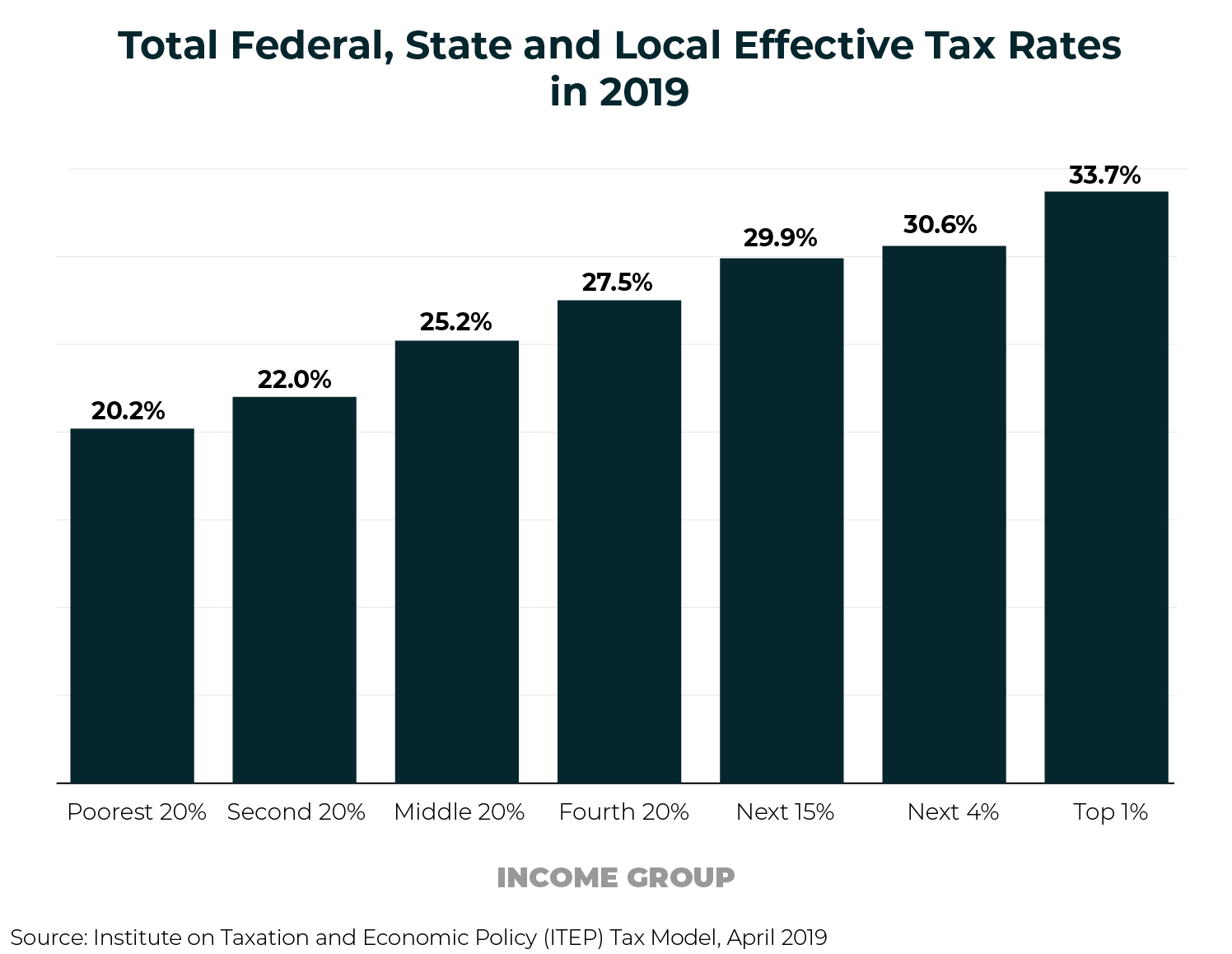

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

Jayme Closs Turns Up Like A Ghost On A Wisconsin Street 70 Miles From Where Her Parents Were Shot Dead At Home Cnn Turn Up Wisconsin Turn Ons

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable Retirement 401k Chart Average Retirement Savings Saving For Retirement

South Carolina Retirement Tax Friendliness Smartasset Com Income Tax Brackets Retirement Retirement Income

Old House In South Carolina By Almassengale Via Flickr Old Abandoned Houses Abandoned Houses Old Houses

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Jayson Bates On Twitter Marketing Jobs Millennials Real Estate Infographic

Who Pays Taxes In America In 2019 Itep

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Research Poster Assignment Rubric In 2021 Research Poster Essay Outline Rubrics

ป กพ นในบอร ด Best Selling Products

Happy New Year 2019 Happy New Year 2019 Happy New Happy New Year

Who Pays Taxes In America In 2019 Itep

Full Service Weddings At Willowdale Estate In Topsfield Massachusetts Tent Wedding Reception White Tent Wedding Blue Wedding Receptions